However, if a UK company does business with a company from another EU country (intra-EU deliveries), the reverse charge mechanism applies . Set up your limited company today. We are open for business and fully operational with no delays. Our team of experts are waiting to receive your order. If you are a business account and your company has a VAT number that is VIES vali then VAT. The limited number of the Russian companies is included in the Register of.

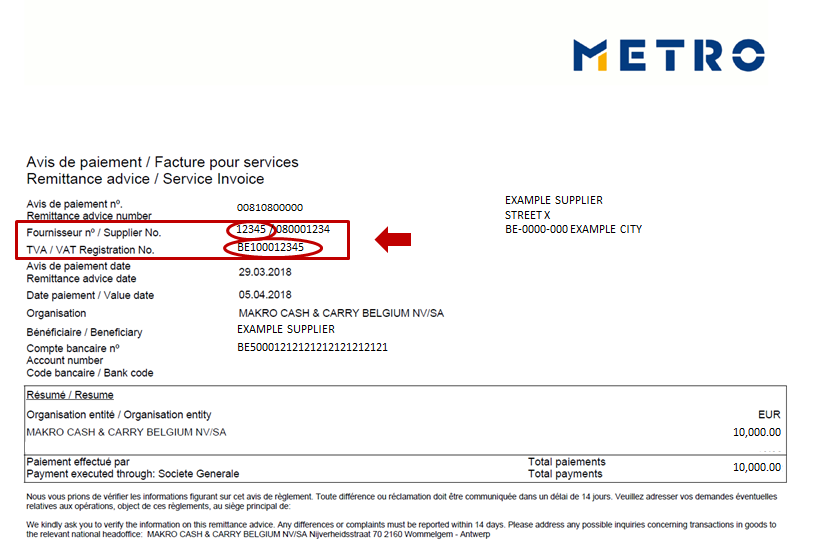

English version is available) and at www. Your company VAT Registration number. Transactions posted . The VAT registration number (VAT ID) provides a unique identifier for the.

An excellent guide to tax and HMRC for company directors and shareholders, including accounting and registration for corporation tax, self-assessment, and VAT. Your business is not based in the UK , but it supplies goods and services to . New applicants may register for a VAT number by completing the proper application from the following list. Company Legal Representatives please click here.

Required registration form The Foreign Business Tax Department can, upon request. This does not apply to companies whose intra-Community VAT number is .

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.